What is CIF (Cost Insurance and Freight) Incoterms?

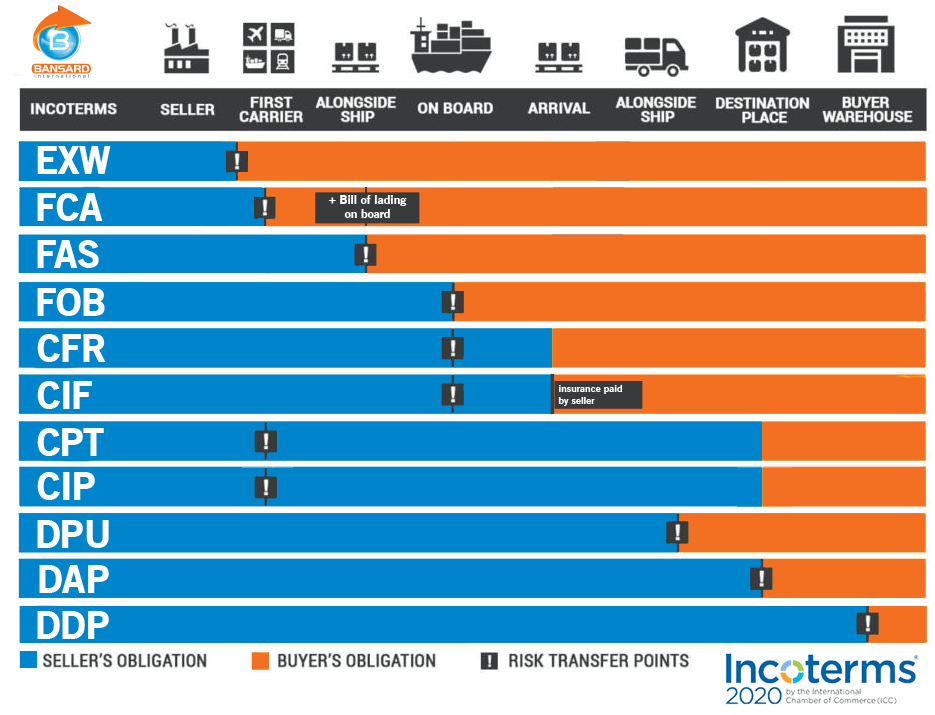

Defining the CIF Incoterm (Cost Insurance and Freight): Seller responisbility for shipment + insurance and courier charges until the destination but import duty has to paid by buyer. check image below for different incoterms.

CIF vs. Other Incoterms

- FOB (Free On Board): Under FOB, the seller is responsible for delivering the goods to the named port of shipment. The buyer assumes responsibility and risk once the goods are on board the vessel. FOB is often used for goods transported by sea and is more seller-friendly than CIF.

- CIP (Carriage and Insurance Paid To): CIP is similar to CIF but provides a higher level of insurance coverage. Under CIP, the seller is responsible for delivering the goods to a destination and purchasing insurance. The risk transfers to the buyer once the goods are handed over to the first carrier.

- EXW (Ex Works): In an EXW agreement, the seller’s responsibilities are minimal. The buyer is responsible for all transportation, insurance, and risk from the seller’s location. EXW places a higher burden on the buyer for logistics and risk management.

Incoterms (11)

The Incoterms or International Commercial Terms are a series of predefined commercial terms published by the International Chamber of Commerce relating to international commercial law.

- Cost: This refers to the cost of the goods themselves, including their price, production, and any other related expenses incurred by the seller before the goods are loaded onto the transportation vessel.

- Insurance: CIF requires the seller to purchase insurance coverage for the goods during transit. This insurance safeguards against potential damage, loss, or theft that may occur while the goods are in transit to the buyer’s final destination.

- Freight: The term freight encompasses the cost of transporting the goods from the seller’s location to the agreed-upon destination port or location.

- EXW (Ex Works place)

- FCA (free carrier AI place

- FAS free along ship port

- FOB Free on board Port

- CFR /CNF: COnst & freight Port

- CIF: Cost & insurance & freight Port

- CPT: carriage Paid place

- CIP: carriage & ins Ppaid place

- DAT: Delivered at Terminal (Port/place) / DPU : Delivery at Place Unloaded

- DAP: delivered at place

- DDP: delivery duty paid

services:

warehouse services

loading @origin

inland transportation

forwarder & customs

terminal charges

loading on vessel

ocean/Air freight

insurance

unloading & loading

transport to destin

customs clearance

Import duties

Cost, Insurance, and Freight (CIF) :

Free on Board (FOB) :

CNF: Cost No insurance and Freight.

Custom House Agent:

“ex-factory” price, EXW

Products available at seller’s warehouse, buyer has to take care from seller warehouse to end.

DDP (Delivered Duty Paid)

price of goods + export taxes + shipping charges + Import duty + local courier Paid by seller.

Delivered at Place (DAP).

price of goods + export taxes + shipping charges + Import duty + local courier Paid by buyer.

DAT – Delivered At Terminal (named terminal at port or place of destination)

VAT / GST

GST on Imported duty.

Reimbursement of gst on export available in india.